San Francisco, famously known for its picturesque views, iconic landmarks, and bustling tech industry, is a city that attracts people from all walks of life.

Whether you’re a homeowner or considering purchasing property in this vibrant metropolis, understanding San Francisco property tax is essential. San Francisco property taxes play a crucial role in funding local services and infrastructure, but they can also significantly impact homeowners’ financial obligations.

If you are a homeowner or investor wanting to learn more about property taxes in San Francisco, you have come to the right place! We will explore factors that affect property tax, shedding light on its calculation methods, assessment process, and payment process.

Let’s get started to help you plan your finances and assist you in navigating the San Francisco property taxes confidently!

Property Tax Assessment in San Francisco

Credit: Image by Trent Erwin | Unsplash

Property tax assessment is the process by which the value of a property is determined for tax purposes. The San Francisco Tax Assessor determines the assessed value, considering various factors such as recent property sales and any applicable exemptions. Note that a change in ownership or new construction triggers a new assessment.

The assessed value of a property or asset can often be lowered by applying for a qualifying exemption. Local governments and tax authorities are common sources of exemptions, and their purpose is to alleviate hardship or provide preferential treatment for qualified property owners.

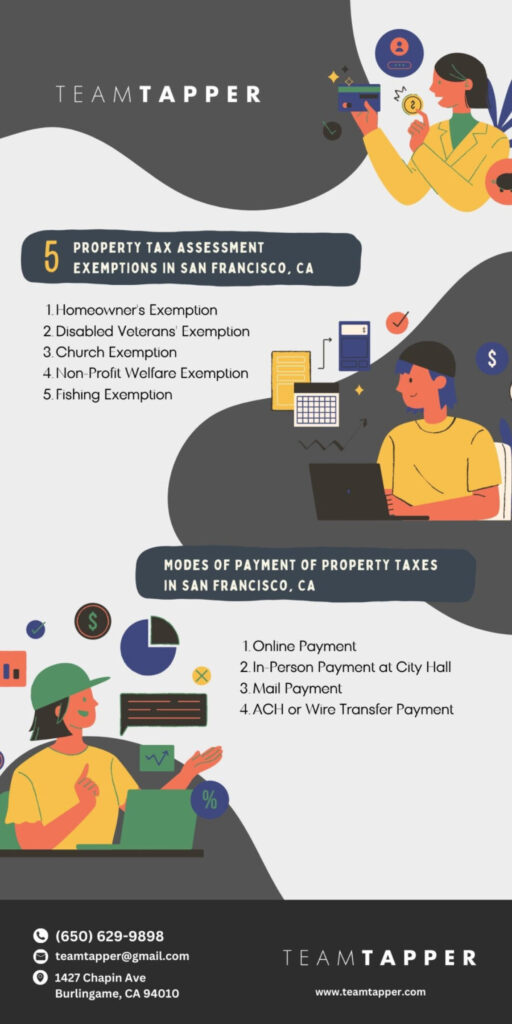

There are currently five property tax assessment exemptions you can apply for if you are qualified:

By owning and residing in your home as your primary residence, you can save approximately $70 to $80 per year on your property taxes. If you meet the criteria, you can lower the assessed value of your property by up to $7,000, leading to reduced property tax obligations.

How to Qualify?

- Must be the owner, co-owner, or named purchaser of the subject property.

- Property must be made the permanent home as of January 1st of each year.

- Rental, vacant, or secondary residences are not eligible for the exemption.

- Eligibility for the entire exemption if you live in the home on January 1st and file the tax return before February 15th at 5 PM.

- 80% of the exemption is available if the claim is submitted between February 16th and December 10th at 5 PM.

- Supplemental assessment may also qualify for the homeowner exemption.

Up to $161,083 can be exempted for veterans who are either totally disabled or partially disabled. Those unemployable are also eligible, including their unmarried surviving spouses.

How to Qualify?

- Veterans of the United States Armed Forces who are incapacitated or unable to work due to a service-related injury or illness are qualified.

- California residents as of January 1st of the year for which they are seeking.

- The 100% disabled veteran might get a $241,627 exemption if their family's annual income does not exceed $72,335.

This exemption is the most stringent among the available options for churches. It demands that the organization’s property be utilized exclusively for religious worship and other activities essential for fulfilling the church’s religious purposes. Areas within the church premises utilized for activities unrelated to worship or as residential quarters are not eligible for exemption.

When churches lease property, the church and the property owner (Lessor) can submit a claim (BOE-263 Lessors Claim). The lessee church will benefit from any reduction in property taxes resulting from the claim.

How to Qualify?

- The Church Exemption encompasses properties owned, leased, or rented by religious organizations solely dedicated to religious worship services, as specified in Article XIII of the California Constitution and Revenue and Taxation Code section 206.

- To qualify for a full exemption, it is necessary for churches to annually file their claims for church exemptions with the Assessor, ensuring that the submission is made no later than February 15th.

The Non-Profit Exemption is a specific type of exemption that pertains to both real estate and personal property. It exclusively applies to non-profit organizations, meaning they are formed for religious activities, scientific research, healthcare services, or charitable endeavors.

To initiate the process of obtaining the Welfare exemption for the first time, an organization is required to follow a two-step application procedure:

- Apply for an Organizational Clearance Certificate to the California Board of Equalization.

- File a separate claim for the Welfare exemption with the county assessor in the specific county where the property is situated or utilized by the organization.

The Fishing Exemption allows owners of Commercial Fishing Boats to benefit from a significant reduction of 96% in their property assessment.

How to Qualify?

- You must submit an Affidavit of 4% Assessment of Certain Vessels (Form BOE 576-E) to the Assessor-Recorder's Business Personal Property Division. The deadline for filing this form is February 15th.

- If you submit the form between February 16th and August 1st, you will still be eligible for a reduced assessment, but at a rate of 80%.

San Francisco Property Tax Rate and Tax Bill

Credit: Image by Recha Oktaviani | Unsplash

To calculate your San Francisco property tax bill, you can use this formula:

San Francisco Property Tax Bill = (1% of Assessed Value + Voter-Approved Bonds + Fixed-Charge Special Assessments) – Tax Exemptions.

For example, the assessed value of a single-family home in San Francisco is $975,000; the voter-approved bonds are $500, fixed-charge special assessments are $200, and it has a tax exemption of $300.

First, Let us get 1% of $975,000, which is $9750 (1% x $975,000). Then, we add the sum of voter-approved bonds and fixed-charge special assessments, which is $10,450 ($9750 + $500 + $200).

Once we have added all the factors, we will subtract the tax exemptions, giving you $10,150 ($9750-$300) as your San Francisco property tax bill.

The County Assessor determines the property’s value based on market value, property improvements, and exemptions. The assessed value is usually lower than the market value of the property.

San Francisco property tax rate is generally 1% of the assessed value, which is the base tax rate in California. However, under Proposition 13, a property’s assessed value is determined when first acquired and, if no new assessment is triggered, can increase annually by a maximum of 2% or the inflation rate, whichever is lower.

To understand that better, when a property changes ownership, it typically leads to a new assessment, which can cause significantly higher property taxes compared to what the current homeowner is paying. Homeowners who have owned their property for a long time usually benefit from lower tax liabilities due to assessed values limited to a maximum annual increase of 2%.

For the fiscal year 2021/2022, the inflation factor used to adjust the assessed values of properties was 1.036%. This factor represents the inflation rate or increase in property values over the previous year. Meaning the assessed values of properties in San Francisco increased by 1.036% compared to the values from the last fiscal year.

Inflation factors vary yearly, so expect it to be different this year, 2023. The inflation factor aims to adjust the assessed values to reflect the current market conditions, ensuring property taxes are based on the most up-to-date property values.

Also, there is a limitation in the annual increase in assessed values to 2% to provide stability in property tax assessments, preventing significant increases in property taxes that could result from rapid appreciation of property values.

Voters in San Francisco can approve tax levies for specific services or improvements, such as infrastructure projects or education bonds. On the other hand, fixed-charge special assessments are any fixed-charge assessments, like Mello-Roos, imposed to pay for particular public facilities or services in designated districts.

By subtracting the total tax exemptions from the sum of the assessed value, voter-approved bonds, and fixed-charge special assessments, you can now get your property tax bill for San Francisco.

Note that your property tax bill is commonly lower than the home value, as San Francisco property taxes are based on the assessed/appraised value of the property, which, as mentioned, is often lower than the home’s market value or purchase price. But, sometimes, it can be higher due to factors like voter-approved bonds and fixed-charge assessments.

Property Tax Payment

Credit: Image by Christin Hume | Unsplash

Once the assessed value is determined, the Auditor/Controller applies the current tax rate to calculate the property tax liability. The San Francisco Tax Collector will then mail property tax bills to homeowners.

According to the San Francisco Property Tax Timeline, all taxpayers in the county will receive their property tax bill on November 1st. The deadline for payment for the first installment is on December 10th, and the second installment is on April 10th. It will be considered delinquent if you fail to pay by 5 PM on December 10th (first installment) or April 10th (second installment).

In such cases, you will incur a penalty of 10% on the delinquent property taxes, and if the second installment is late, there will also be an additional administrative fee of $45. On June 30th, property taxes in the City of San Francisco became tax-defaulted. Failure to pay San Francisco property taxes by this date will subject the owner to additional penalties, including a 1.5% monthly charge and a redemption fee.

Here are some ways to pay your property tax in San Francisco:

1. Online Payment

You can pay online through electronic check (eCheck) for free by entering your checking account information, but if you use a debit and credit card, you will have to pay a 2.25% $2.00 minimum fee.

Visit San Francisco’s Treasurer and Tax Collector web page should you opt online to pay.

2. In-Person Payment at City Hall

You can also visit the City hall every Monday to Friday, from 8 AM to 5 PM.

3. Mail Payment

Another payment option is to send a money order payable/check to “SF Tax Collector.”

Tax payments must be received or postmarked by the due date to avoid penalties. Once the payment is received after the due date without a postmark, it is considered late, and penalties will be applied.

4. ACH or Wire Transfer Payment

To electronically transfer payment to the City and County of San Francisco’s account through ACH or Wire Transfer, you must provide the following instructions to your financial institution.

| Header #1 | Header #2 |

|---|---|

| General Bank Reference Address: | JPMorgan Chase, New York, NY 10017 |

| ABA/Routing Number: | ACH: 028000024 FedWire: 021000021 SWIFT code: CHASUS33 |

| Bank Account Number: | 20000043472203 |

| Bank Account Name: | City and County of San Francisco |

| For credit to: | Property Tax (TTX) |

You must provide the payment details using a Worksheet Template if you pay more than ten tax bills using a single ACH transaction and send it to PTwires.TTX@sfgov.org.

Conclusion

Understanding property tax assessment and how it is paid in San Francisco is essential for homeowners and prospective buyers. The property taxes in San Francisco, CA, carry significant weight and serve as a vital source of funding for essential services and the upkeep of the city’s infrastructure.

As homeowners and investors, understanding the complexities and technicalities of property tax assessments. It will guarantee that you are paying the accurate amount of taxes and maximizing any exemptions that may be available. By maintaining a proactive and well-informed approach, we can safeguard our investments and achieve long-term financial benefits.

It also helps homeowners to manage their tax obligations and plan their finances smartly and effectively. Staying informed about the assessment process, exemptions, and available payment methods will help you as a homeowner to navigate the property tax system of San Francisco confidently.

Take the first step today by consulting with a qualified professional to maximize your knowledge and minimize your tax burden. You can book an appointment with us by calling (650) 629-9898 or emailing teamtapper@gmail.com.

Want to hear the latest news about San Francisco, CA? Join our online community today and be part of the conversation!

Credit: Image by Scott Graham | Unsplash

Frequently Asked Questions

How is property tax calculated in San Francisco?

Your San Francisco property tax bill is calculated by adding 1% of assessed value, voter-approved bonds, and fixed-charge special assessments and subtracting its total from tax exemptions.

How can I lower my property taxes in San Francisco?

To reduce your property tax, you can apply for property tax exemptions, such as Homeowners’ Exemption or Disabled Veterans’ Exemption.

You can also file an appeal to the San Francisco Assessment Appeals Board if you think the assessed value of your property is overvalued.

Are property taxes public record in California?

Property taxes and the property’s assessed value are public records in California but limit access to specific details, such as the homeowner’s personal contact information or other sensitive data.

Each county has an office responsible for recording property tax records. If you want to look for property tax information, you can visit a specific county’s website or online portal.