Hi readers, welcome back! Today we’re tackling a hot topic all over the nation– Is San Mateo County in a ‘Housing Bubble’? And if we are in a bubble, is it going to pop?

Morgan: Let’s jump right in—what do you think about the term ‘Housing Bubble’ in relation to the San Francisco and San Mateo counties housing market?

David: We are still a ways away from the ‘Housing Bubble’. Homes are still selling, some taking a bit longer, especially condos. But there is no lack of money here on the San Francisco Peninsula.

Morgan: How has the market been since we last checked in during our last Q & A (What Does Low Inventory Mean for Sellers)?

David: The market is still healthy, it’s still a ‘Sellers Market’ with low inventory, but some buyers are starting to get priced out. With the cost of money rising, buyers are beginning to feel the pinch, especially those at the entry level.

Morgan: What does this mean for buyers looking to buy real estate in San Mateo County?

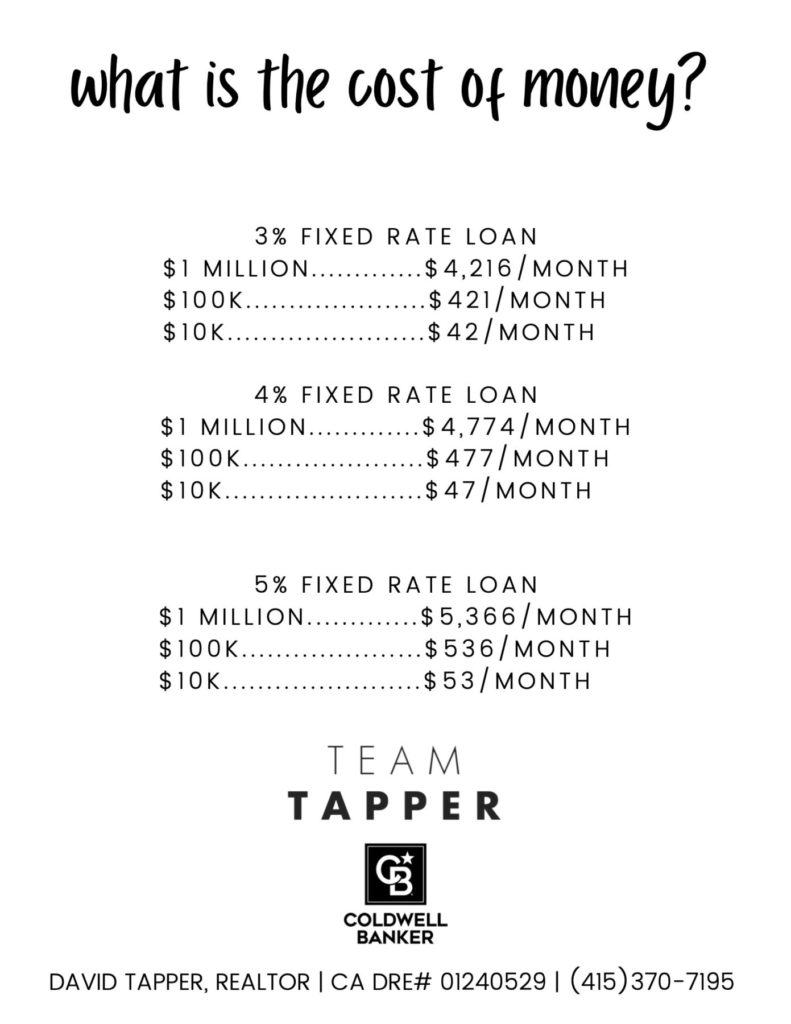

David: At the beginning of 2022 you could still get a fixed rate loan close to 3%, now it’s in the 5.5% range and many feel it will only go up to fight inflation. For every 1% that the cost of money rises, buyers lose 10% of their buying power, so if you don’t have the additional down payment to make up that 10%, simple math tells us buyers won’t be able to afford as much home.

Morgan: Continually rising rates seems scary, I’d imagine this has started to have a dramatic effect on sellers trying to sell their homes in San Francisco and San Mateo counties?

David: It hasn’t hurt the sellers of single family homes yet, but it’s starting to affect the condo sellers. What is scary, is that at some point, sellers will start to feel it across the board if rates continue to climb with the stock market falling. Everything has to do with consumer confidence, and as we have all seen, the stock market has been volatile. The Dow peaked at close to 36,950+/- and as of 5/27/22 it’s at 33,212 going up 576, just Friday (rounding it out as a good week for the market). The Nasdaq has been hit hard, and many of our local clients have strong holdings in the tech sector—it peaked at 16,200 + and closed at 12,131, going up 390, on Friday.

Morgan: So if we’re not currently in a ‘Housing Bubble’ here in San Francisco and San Mateo counties, are you hopeful that we will avoid one all together?

David: Well, there are two points that I think are important to explain to anyone curious about our housing market and its forecast– The first is that we are in a very unique area of the world, with very desirable land. I’ve mentioned this previously, but the fact that San Francisco and San Mateo counties are surrounded by water and home to tech/fintech/biotech’s largest corporations makes the San Francisco Peninsula a bit resistant to the same types of harder hits other housing markets may take. There will be leveling out that happens and because real estate moves in cyclical patterns, historically, it’s not a bad thing. The next point to take into consideration– When we saw the last BIG bubble burst, it was in 2007/2008 and a large part of that was due to the bad loan situation. We don’t have that anymore, and now, more than ever, we see clients who are very liquid– lots of all cash purchases and none of the 100% financing.