Managing an estate after someone’s death is not an easy task. At some point, you may hear or get involved in a trust sale or probate sale of a property.

While they share similarities that the homeowner passed away and their estate is now selling the property, both are also quite different, especially when discussing the court involvement.

This article will assist you in comprehending and navigating the distinctions and procedures associated with trust and probate sales.

Trust Sale

In a Trust sale, no particular action is required from the buyer since the deceased homeowner’s instructions for selling the home are already in the trust.

Trust sale allows the estate to handle things without the involvement of the court system, which saves a lot of time and money.

Usually, this type of estate sale has one decision maker, the trustee, who can sell the property. Sometimes, several siblings are trustees and decision-makers, too. Although more trustees can make decisions, it can make the decision-making process challenging.

Trust Structure

A revocable living trust is a legal document for what happens to your asset after you pass away. When your assets are in the trust, they don’t have to go through a complicated legal process called probate upon your death.

In a revocable living trust, once the assets are put into a trust, you no longer own them; they belong to the trust. However, because it is a revocable living trust, you will still have control of the assets as long as you’re alive, even though they no longer belong to you.

Therefore, a revocable trust can be changed or voided whenever you want, and you will remain the trustee. You can change or update your decisions as you see fit. For instance, you can change the beneficiary after a revocable living trust has been set up.

An irrevocable trust is a trust the grantor cannot change or revoke without the beneficiary’s or court’s order permission. The grantor or creator gives up all control of the assets they put into irrevocable trusts. Thus, their ownership right to the assets is legally removed.

With irrevocable trust, you can reduce estate taxes and help avoid the probate process upon death.

There are different types of irrevocable trusts, so it will be best to inquire about an estate planning attorney or realtor to help determine what works best for your situation.

Here are some examples of irrevocable trusts:

Grantor-Retained Annuity Trusts (GRATs) and Qualified Personal Residence Trusts (QPRTs)

It allows the grantor to put their asset in a temporary trust and freeze their value, preventing additional appreciation in the asset’s value within the person’s estate. Instead, any further growth goes to heirs with lower taxes.

During the GRAT term, the trust pays the grantor an annuity, so the assets in the GRAT are considered returned to the grantor.

Generation-Skipping Trusts and Dynasty Trusts

It helps protect your children or generations of heirs from estate taxes. With a generation-skipping trust, you can transfer money to your grandchildren or others at least 37.5 years younger than you.

Spendthrift Trusts

When beneficiaries are not good at handling finances, the trustee decides when and how the beneficiary is allowed to use the money.

Special Needs Trusts (also known as Supplemental Needs Trusts)

It assists individuals with functional needs in obtaining financial aid without affecting their eligibility for government benefits like Medicaid or Supplemental Security Income (SSI).

Sale Process

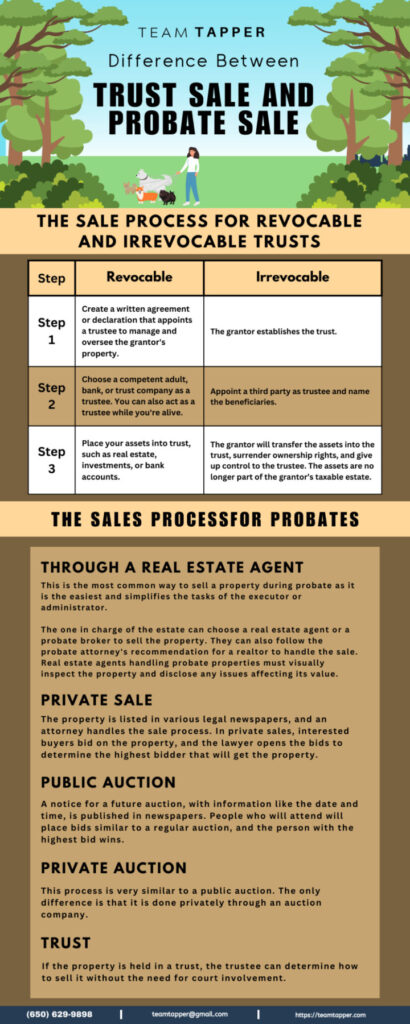

As mentioned, trust sales have two types of structure: revocable and irrevocable. These two have different ways of processing, as shown below:

| Step | Revocable | Irrevocable |

|---|---|---|

| Step 1 | Create a written agreement or declaration that appoints a trustee to manage and oversee the grantor's property. | The grantor establishes the trust. |

| Step 2 | Choose a competent adult, bank, or trust company as a trustee. You can also act as a trustee while you're alive. | Appoint a third party as trustee and name the beneficiaries. |

| Step 3 | Place your assets into trust, such as real estate, investments, or bank accounts. | The grantor will transfer the assets into the trust, surrender ownership rights, and give up control to the trustee. The assets are no longer part of the grantor’s taxable estate. |

Trustee’s Authority

The trustee’s authority to sell property in trust depends on the trust agreement. So, the trustee must understand the written agreement to adhere to its instructions while administering the trust.

The trustee might need to turn trust assets into cash to provide liquidity when administering a trust. This can involve selling things like valuable properties. While the trustee is expected to make intelligent financial decisions that benefit the beneficiaries, they usually don’t have to get approval from the beneficiaries for a trust sale.

However, some trustees might ask for approval to avoid potential legal issues. The main rule is that trustees can’t sell trust property for their gain unless they’re also trust beneficiaries.

Furthermore, as mentioned, the trustee must follow the instructions in the trust agreement. If it specifies that the trustee should distribute money or property to beneficiaries at a certain date or upon meeting specific conditions, the trustee must follow it.

That is why making informed decisions when creating a trust and defining the trustee’s role and responsibilities is crucial.

Trustees also gain authority from the laws of the state where the trust is located, which often outlines specific rules that trustees must follow.

Beneficiary Notifications

Beneficiary notification is a process that informs the qualified beneficiaries of the trust about the trust sale or the disposition of trust assets.

The fundamental right of beneficiaries is to have the trust appropriately administered according to the law and the written document. Beneficiaries are entitled to know the trust’s existence and understand their rights.

The trustee will usually send a notice letter telling the beneficiaries about the trust and give them the trustee’s name and address. Trust beneficiaries should expect trustees to provide helpful responses to valid requests for information.

Generally speaking, Trustees should disclose, and beneficiaries can expect to see or get copies of the following:

- Documents of the terms of the trust, such as the will or trust document and any variations.

- Documents that confirm the identity of the trustees, like the deeds of appointment/retirement.

- Documents that show the extent of the trust assets, including trust accounts.

Beneficiaries are not generally entitled to get documents about how trustees make decisions, such as:

- Letters of wishes.

- Correspondence between trustees or other beneficiaries.

- Correspondence with professional advisors or advice obtained.

- Topics discussed and notes taken during trustee meetings.

Why? Because trustees don’t need to explain why they use their powers or discretions. Moreover, letters of wishes are usually kept confidential to the trustees.

How Long Does a Trustee Have to Notify Beneficiaries?

Notification to beneficiaries varies per state. However, the deadline is commonly within 30 or 60 days of the settlor’s death.

In California, the trustee has 60 days after becoming a trustee or 60 days after the death of the settlor’ whichever comes later, to send a written notice to all trust beneficiaries.

Consequences of Failure to Notify Beneficiaries

Trustees are responsible for always acting in the best interests of trust beneficiaries. Failing to do so can result in removal as a trustee. In California, not notifying beneficiaries can lead to responsibility for damages, attorney’s fees, and costs.

Besides legal reasons, it’s recommended to keep beneficiaries informed to build a communicative relationship and prevent issues in the future.

Taxes and Liabilities

Capital Gains Tax

Capital gains tax is a form of tax paid on the profit from selling assets in a trust( trust sales real estate or investments) when the selling price is higher than what you originally paid for it.

Since capital gains are earned from the increase in the value of the investment, capital gains are taxed differently. These distinctions are typically categorized as either short-term (less than a year) or long-term (at least a year).

Short-term capital gains are from the profits of selling investments you’ve owned for less than a year. The government taxes these earnings at regular rates as your steady income. You might pay more than 20% in taxes, depending on your income.

If you own the asset for more than a year before selling it, you typically pay a lower tax called long-term capital gains tax. The government charges less for this tax than short-term gains or regular income tax.

The table below shows the tax rates that apply to capital gains in California as of May 2023:

| Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 1% | $0 – $8,932 | $0 – $17,864 | $0 – $8,932 | $0 – $17,864 |

| 2% | $8,933 – $21,175 | $17,865 – $42,350 | $8,933 – $21,175 | $17,865 – $42,353 |

| 4% | $21,176 – $33,421 | $42,351 – $66,842 | $21,176 – $33,421 | $42,354 – $54,597 |

| 6% | $33,422 – $46,394 | $66,843 – $92,788 | $33,422 – $46,394 | $54,598 – $67,569 |

| 8% | $46,395 – $58,634 | $92,789 – $117,268 | $46,395 – $58,634 | $67,570 – $79,812 |

| 9.3% | $58,635 – $299,508 | $117,269 – $599,016 | $58,635 – $299,508 | $79,813 – $407,329 |

| 10.3% | $299,509 – $359,407 | $599,017 – $718,814 | $299,509 – $359,407 | $407,330 – $488,796 |

| 11.3% (plus 1% for income over $1,000,000) | $359,408 – $599,012 | $718,815 – $1,198,024 | $359,408 – $599,012 | $488,797 – $814,658 |

Estate Tax

After the grantor’s death, the money for estate taxes comes from their accounts. If the heirs/beneficiary sells the house, the profit goes into the overall estate and would be responsible for the taxes.

Even though the capital gains tax is still paid, it comes from the trust’s funds, so beneficiaries don’t have to handle it.

Probate Sale

When handling a deceased person’s property, the process is called real estate probate; meanwhile, the sale of the property is called a probate sale.

The court runs a probate sale when someone passes away and doesn’t leave a will to determine who will get their property.

Their property becomes part of their estate, and the person handling that estate acts as the personal representative or fiduciary of the probate home. The probate court oversees the probate process by a legal system and follows the procedures established by the state.

Probate Court Involvement

Court Supervision

In California, there are two kinds of probate sales. The first is when court approval is required, and the other can proceed if the estate representative gets the authority through the Independent Administration of Estates Act (IAEA) without the court’s further say.

Getting IAEA status requires you to file paperwork with the court to ask for permission. However, note that not everyone will get it. Some wills may prohibit that IAEA be administered to anyone, including the chosen Executor.

In some cases, if a person is unreliable or not trustworthy, interested parties or heirs might have valid reasons to oppose the granting of IAEA (Independent Administration of Estates Act). This could result in limited or no authority, leaving the entire process to court involvement.

If a probate sale is planned, the estate representative must inform all heirs with a “Notice of Proposed Action.” Heirs have 15 days to object; if no objections are raised, the sale can proceed.

To proceed with the sale without waiting 15 days, all heirs must unanimously agree and sign a “Waiver of Notice of Proposed Action.” The deal must go to court for confirmation if an objection cannot be resolved.

Executor’s Role

The Executor (if there’s a will) or administrator (if there’s no will) is chosen by the court to manage the deceased estate.

The Executor handles debts and taxes, takes care of all assets, and distributes what’s left to the rightful beneficiaries according to the law and the will. If someone sues the estate, the Executor defends it, and if the estate has a claim against someone else, the Executor may file a lawsuit.

Aside from that, the following are what executors will also typically do:

- Locate all assets of the estate and care for them.

- Pay expenses necessary to maintain the assets.

- Paying expenses necessary to keep the assets secure, such as mortgage payments, utility bills, and insurance.

- Pay income taxes that may become due. Pay any other taxes rightfully due.

- Pay estate taxes.

- Manages the everyday tasks such as ending leases, settling outstanding contracts, notifying banks, and dealing with governmental agencies, among other responsibilities.

- Set up the estate bank and brokerage accounts to keep income flowing during the estate’s life.

- Locate heirs and keep them advised of the progress of the estate. Filing requisite notices.

- Overseeing the distribution of assets and submitting the required petitions to the court.

Sales Process

Appraisal and Listing

When selling the property, it must first be appraised to determine its estimated sale value based on current market conditions. A professional appraiser will check out the home and set a price range.

After that, the property will be listed on the market. This is done the usual way with yard signs and online listings, but the realtor has to mention that it’s a probate sale in the listing.

In California, there are different processes to conduct probate sales:

| Process | How it Works |

|---|---|

| Through a Real Estate Agent | This is the most common way to sell a property during probate as it is the easiest and simplifies the tasks of the executor or administrator. The one in charge of the estate can choose a real estate agent or a probate broker to sell the property. They can also follow the probate attorney's recommendation for a realtor to handle the sale. Real estate agents handling probate properties must visually inspect the property and disclose any issues affecting its value. |

| Private Sale | The property is listed in various legal newspapers, and an attorney handles the sale process. In private sales, interested buyers bid on the property, and the lawyer opens the bids to determine the highest bidder that will get the property. |

| Public Auction | A notice for a future auction, with information like the date and time, is published in newspapers. People who will attend will place bids similar to a regular auction, and the person with the highest bid wins. |

| Private Auction | This process is very similar to a public auction. The only difference is that it is done privately through an auction company. |

| Trust | If the property is held in a trust, the trustee can determine how to sell it without the need for court involvement. |

Court Confirmation

The waiting period begins when the property is listed until potential buyers make offers. When a request arrives, it’s not simply accepted. Instead, the Executor informs the probate attorney, who sets a court date, and during this time, more offers can be considered.

When the court date comes, successful bidders attend, and an auction happens. Buyers can raise bids to outdo others until the judge approves a final offer.

Taxes and Liabilities

Debts and Claims

Once the court appoints an executor or administrator and they get access to funds, they can start paying the bills.

If a creditor believes they are owed money from the deceased person’s estate, they need to submit a creditor’s claim for approval by the Executor or administrator. If the Executor or administrator requires the creditor to submit this form, they must send a notice to the creditor.

Usually, claims must be submitted within four months, but there’s an exception if the creditor didn’t know about the death. In that case, they can ask the court for permission to submit a claim even after four months but not later than one year after the Executor or administrator was appointed.

If the Executor or administrator rejects the creditor’s claim, the creditor has three months to file a case or lose the right to sue later. Before filing a case, the creditor must first submit a claim. Most estates do not involve any contested creditor’s claims. The Executor or administrator pays the bills, and everything goes smoothly.

Capital Gains Tax

During probate, the Executor has to handle and pay various taxes, like Inheritance Tax, Income Tax, and Capital Gains Tax. Like a trust sale, Capital Gains Tax is a tax you pay when selling a property for more than you bought it for.

If the Executor needs to sell the property during probate to give beneficiaries money instead of the property, they might have to pay capital gains tax on the profit.

This tax has to be paid from the estate’s money and must settle capital gains tax within 60 days of finishing the sale before beneficiaries get their share.

Capital Gains Tax is based on the difference between the property’s value during probate and its selling price minus any expenses and the estate’s annual tax-free allowance.

Final Thoughts

The difference between trust sales and probate sales lies in court involvement.

Trust sales generally offer more flexibility, efficiency, and control for beneficiaries, as they don’t involve the court for the estate to act. It has two different structures: irrevocable trusts and revocable, where the difference lies in who controls the assets in the trust.

Meanwhile, probate sales involve court supervision, making the process more structured and long. Executors or administrators manage the deceased person’s estate, handling debts, taxes, and property sales under court supervision.

If you have any questions about estate sales or need assistance selling your property, do not hesitate to contact me or my team. We will be glad to help you throughout your real estate journey. You can also visit our website to learn more about California or see available homes for sale.

We also invite you to follow us on our social media to be updated with the latest news about San Mateo, CA:

Frequently Asked Questions

What happens if a property in probate has outstanding debts?

If the deceased owed an outstanding debt, the assets in the estate will be sold, and the profit will be used to settle those debts. The person responsible for handling this process is a lawyer or an executor specified in the deceased person’s will.

Are Probate Sales more time-consuming than Trust Sales?

Yes. Since the court is involved in asset distribution and there are legal steps to follow, probate sales will take longer, especially since court approval is often required to proceed with the sale. There’s also a lot of paperwork to do, and a sale usually takes months to close.

Can a property in a trust be sold without the trustor’s consent?

The trustee’s ability to sell a property will depend on the terms outlined in the trust agreement of the grantor. If the trustor grants authority, the trustee can sell the trust property without seeking permission from the trustor or even the beneficiary. However, some trustees ask for approval to avoid potential legal issues.

Can a property in probate be sold before court confirmation?

It depends. Often, the court’s approval is required to sell the property. However, there are situations where the estate representative can proceed without court confirmation if granted authority under the Independent Administration of Estates Act (IAEA).

Great and very informative post Tap!