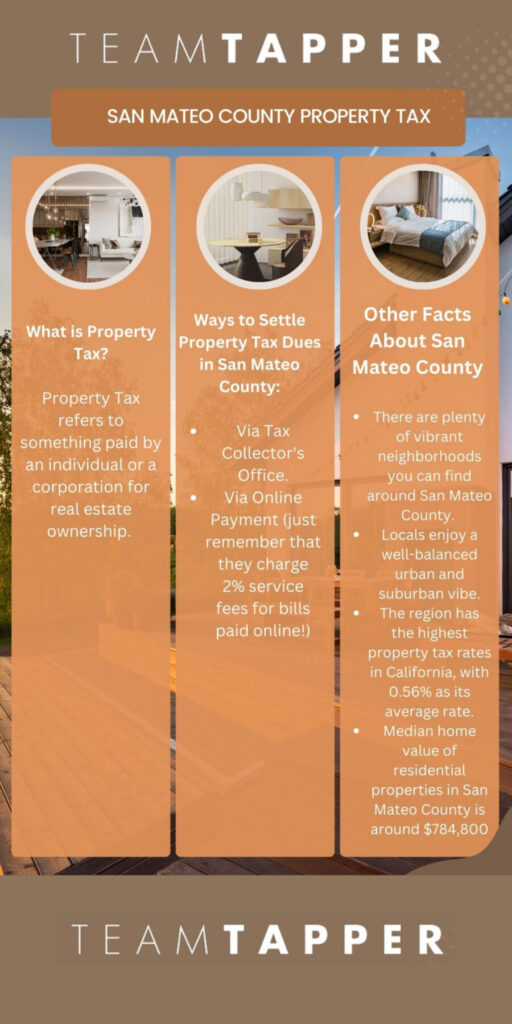

San Mateo County is considered a wealthy region with plenty of vibrant neighborhoods. Aside from the high cost of living, it gives off an urban-suburban vibe where most residents own their places. The environment consists of restaurant chains, coffee shops, and parks where people can perform recreational activities.

The entire lifestyle in the area is liberal and has one of California’s highest property tax rates, with 0.56% as its average rate. Homeowners in this state must be equipped to pay at least $4,424 in property taxes per year based on their median home value of $784,800.

To elaborate on what a property tax is, it refers to something paid by an individual or a corporation for real estate ownership. It can also be considered a regressive tax that impacts lower-income individuals more than wealthy ones.

This is because the government assesses tax as a percentage of the value of the property that a taxpayer owns. This type of tax has no connection with how much an individual earns but relies on its computation of the value of owned assets. If a low-income individual purchases a real estate property, it takes a toll on their finances as a $4,000 annual property tax is quite heavy for low-income earners.

When Are Property Taxes Due in San Mateo County?

San Mateo County Property Taxes can be settled in two installments, which can be paid on or before November 1st as the first installment.

However, if you fail to settle on the mentioned date, you must ensure that you pay the property tax before 5:00 pm on December 10th. Failing to meet the payment deadline adds a 10% penalty on your payables.

The 2nd installment is due and payable on or before February 1st. Taxes become delinquent if the taxpayer fails to settle by April 10th of the following year, which is also subject to another 10% penalty rate.

The average yearly San Mateo County property tax rounds off to about 4.08% of their annual salary. San Mateo County is ranked 210th out of 3,143 counties when it comes to property taxes as a percentage of median income.

How Can I Find Out How Much My Property Taxes Are in San Mateo County?

San Mateo County has a complicated formula for computing and determining the property tax amount individuals owe. It is not possible to condense the exact property tax rate into a simple tax rate.

To find out how much your property taxes are in San Mateo County, you can provide the tax assessor with the current appraisal value of your property, and they will compute the exact property taxes you need to pay.

Your actual property tax burden will still depend on the details and other features of each individual property. The tax assessor provides property tax estimates according to the statistical median of taxable properties in San Mateo County. If you need an exact appraisal value of your property taxes in San Mateo County, you can contact the San Mateo County Tax Assessor.

They cater to client concerns about reporting upgrades or improvements, property tax payments, property tax appraisal appeals, San Mateo County property tax due date confirmation, and your property tax bill. Their office is in Redwood City, California, the county seat of San Mateo County. This is where you can find most government offices.

The San Mateo County Assessor works on assessing property taxes and real estate appraisals. The property tax rate of San Mateo County and the local voter-approved debt is 1% of the assessed value, and both must be paid at this said rate.

If you are a homeowner and an occupant at the said property, you are eligible for an exemption amounting to $7,000 from the home’s assessed value, reducing your property tax rate.

There are no necessary additional charges or long processes for applying for the homeowner exemption program. You will automatically receive an application for the exemption in the mail when you are a new property owner.

The Homeowner exemption program might be categorized under a supplemental assessment if the property could not receive an exemption application letter on the annual assessment roll. You have to remember that the privilege to have this exemption is only limited to first-time homeowners, as a second home purchase will not be qualified in the criteria for this program.

How Can I Pay My San Mateo County Property Taxes?

There are several ways to pay your property taxes, primarily via the Tax Collector’s Office or online payment using a credit or debit card. You can contact the Tax Collector’s Office at (866) 220-0308 or through the website using your Visa, MasterCard, Discover, or American Express credit cards.

The Tax Collector’s Office hotline is open for all concerns regarding property tax inquiries and appeals within the county. They cater to 300,000 tax bills annually and accept payments in cash, check money orders, and credit cards (Visa, MasterCard, Discover, and American Express).

Any credit card payments are handled for you but expect a 2% service fee when paying your property taxes through a card.

Wrap Up

The property taxes may be complicated as there is no exact computation of the amount you need to pay when you have assets or properties in San Mateo County.

If you have properties in the area and need help assessing your property taxes to fully understand the process along with the fees or charges on your assets, please do not hesitate to contact us at (650) 629-9898.

Get to know our team, and follow us on our accounts below to receive new and fresh updates about San Mateo County.

Frequently Asked Questions

What percent is property tax in San Mateo County?

San Mateo County has an average percentage of 0.56% on property tax as the area has the highest median property taxes in the United States.

How to determine the assessed value for business property tax in San Mateo County?

The tax assessor is in charge of annual assessments of personal properties based on their market value on their lien date, which is January 1st of every year.

As a business property owner in San Mateo County, you must provide the annual business property statement, such as business equipment, supplies, and fixtures. The information in the statement will be used to assess and tax the property basing the assessments on California State Law.

How is property tax calculated in San Mateo County?

The only way to calculate a property tax in San Mateo County is to give the complete details of your property to the tax assessor since tax calculations vary from one property to another.

How much is property tax in San Mateo County?

The median property tax in San Mateo County, California is $4,424 per year for a home with a median value of $784,800.